So, I ABSOLUTELY know there’s massive variation in this. Just want to get ahead of that.

What I’m looking for is…what do finances look like, casually, when you have a 100% paid off small (SMALL!) home. When a mortgage is out of the way, what’s left to eat up your paycheck?

I suppose I’m looking for the sort of casual knowledge of expenses for this sort of life that your kids might pick up if they lived in your area with you in your home. En mass, pulled from multiple lemmy folks, so I can get an idea of general trends. I’m partial for info from the USA, but others reading this might appreciate statistics from other areas. :)

(People mistake how valuable this sort of “general idea” info is, I always see people going into the weeds on how every situation is different without bothering even giving a crappy signpost so I can see if I’m looking at a $5 expense or $500 or $5000. Knowing if something is going to be $5 or $5000 is very valuable, even if it’s not some exact precise number. But I don’t need to know if it’s going to be exactly $392.29 if I wiggle my ears and tug my nose to get the right loophole, I just need to know that closer to $500 is correct, or whatever.)

I don’t have family, so I missed out on “casual learning” opportunities, and don’t have anyone to talk to IRL to get this info, so it’s really hard to apply my city-living experience to try to extrapolate what life might be like if I make a goal to buy a small home in Nowheretown, USA to retire in 20 years down the line.

Anyway. So what do expenses look like if you have a small paid off house? What range do utilities run in for you (in your particular climate), what’s home insurance like, what sort of unexpected expenses pop up when you own instead of rent?

What’s utilities like for sewer and trash, especially? Those have always been rolled into my rent. Is rural internet still limited to DSL or satellite (or Starlink I guess these days), or has better infrastructure been rolled out in places over the past 20 years since I last looked for this info?

Edit: Also…talk to me about well water and well expenses, and septic tanks instead of sewer lines, and oil heating. I promise I’ll listen!

Edit 2: Also talk to me about how propane works.

Thanks everyone. :)

If you’re trying to compare cost of living in different areas in the US, there are a number of online websites that will do that.

Here’s one:

https://www.bankrate.com/real-estate/cost-of-living-calculator/

EDIT: That doesn’t answer your question fully, obviously, but it’s probably one piece that you want if you’re trying to find some rural place to move to.

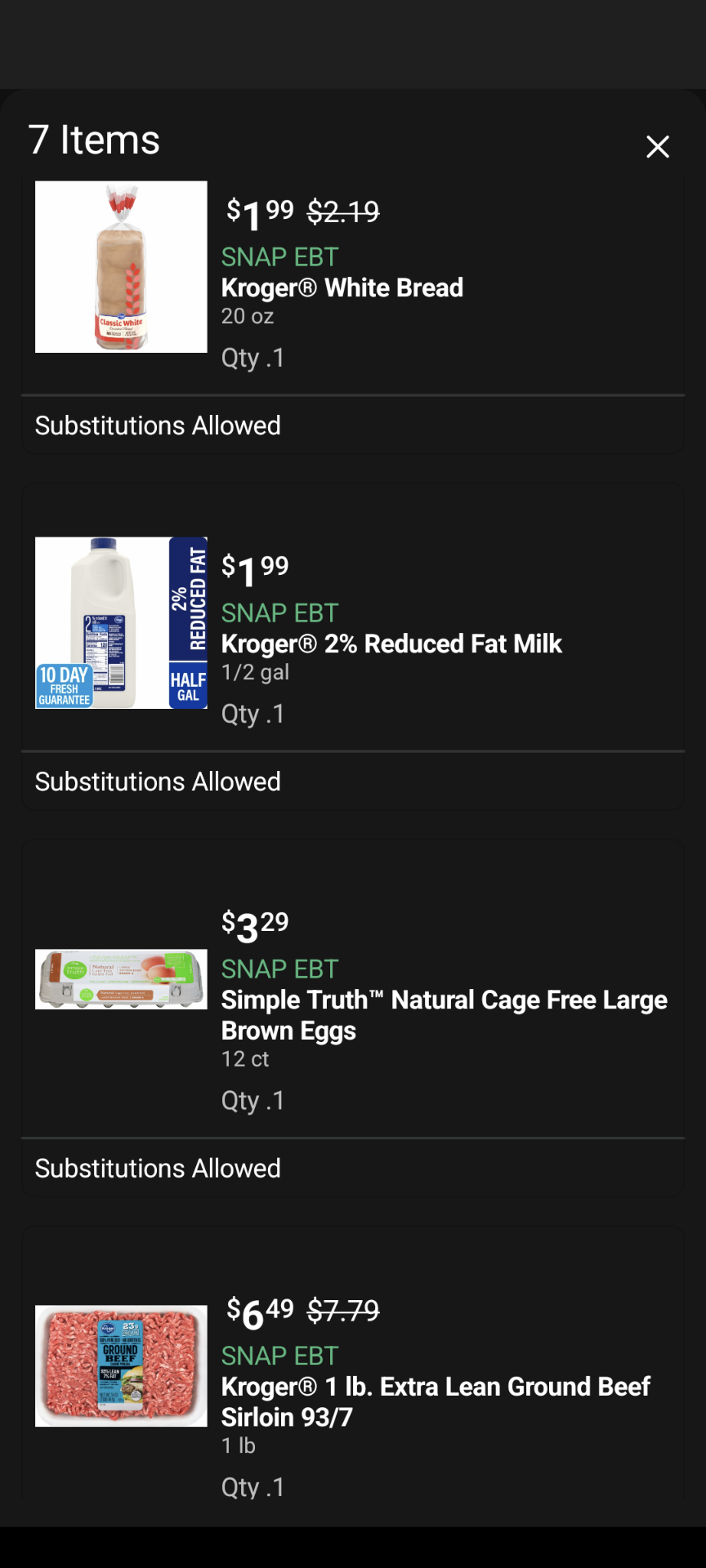

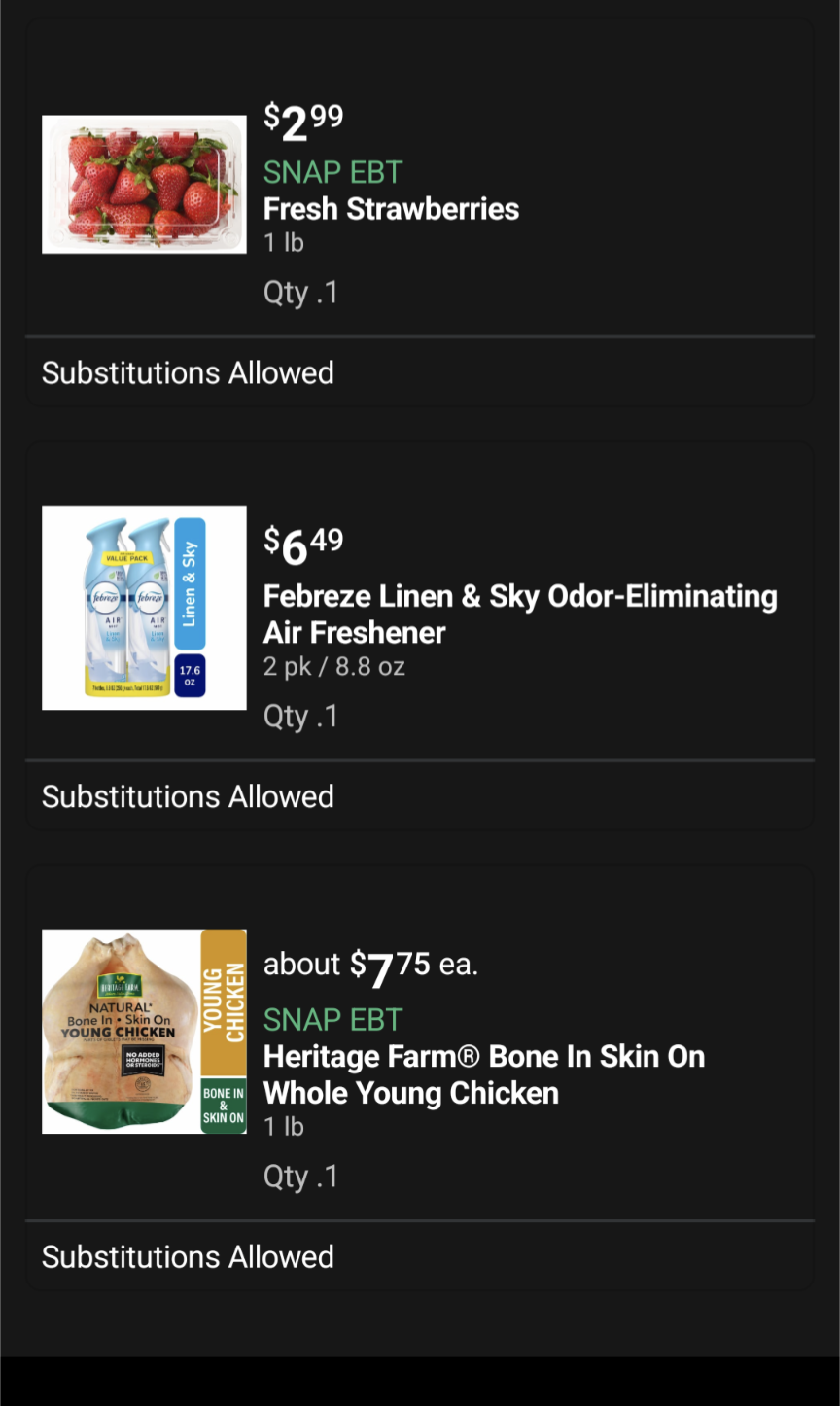

I’m in Dallas Texas. No state income tax, but property tax is about 2% of home value, so even if it’s paid off your looking at ~$500/mo on a $300k house, which is about the minimum in the city here right now. If you’re over a certain age that’s reduced a bit. If you had decent insulation here on a smaller house and you’re cautious with your AC use, you could probably get away with electricity of $100/mo most of the year and $200 in the summer. I think my water/sewer/trash is about $60 a month and my gas is about $60 a month. Our home and auto insurance is high in Texas. I’m cheap, so we use 5g internet for $30/mo. Gas is $2.70/gal here today. I threw a few things in an online grocery cart and screenshotted so you can see our food prices.

So I’m not low low cost. Live on the east coast after moving from a high cost area of living so I could buy a home.

Median household income is ~$80,000 here or $40k per person

I spend ~$3300 a month for two people and pets living comfortably. I removed my mortgage and any car payments but that includes everything from auto insurance, home insurance, auto maintenance for two relatively new cars, groceries and utilities.

Home taxes are $1600/year and home insurance is $550 but average around here are closer to $800. Not included in the total above.

Home is ~1500 sqft

-

~$200 for electric, no gas so that’s mostly air conditioning/heat. Prices go up in summer, don’t get much snow here so Winter is mostly off.

-

~$50 Water includes sewer since we’re connected here. Other commenters can share about being on a well but if your buying off main sewer, expect to pay $$$ when it needs to be replaced. Set aside money as if you had a water payment and take care of it with maintenance.

-

HOA includes trash at $70 a month.

-

Internet, fiber is $50. Subscriptions are ~$45 on top. Phones are $60 for two lines. Most friends in more rural areas have cable/fiber but a few have satellite or just mobile phone Internet. About 2+ hours from nearest metropolitan city. Satellite is terrible and expensive so recommend checking https://broadbandmap.fcc.gov/ before you buy if that’s important to you.

-

Car insurance $200 for two cars covered 300/100. Gas is $200. Auto maintenance is $165 and includes taxes, and all the other fun stuff related to owning cars. – If your young, a guy, have accident history insurance will be higher. Don’t skip if you can’t afford to replace your car and don’t get budget insurance to save. Gas is probably going to depend on your commute. And maintenance is going to depend on your car. Taxes are $300-600 a year each car including property taxes, DMV registration, etc.

-

Groceries, $400-600. Eating out $200. This is probably the biggest variable expense.

-

$400 misc spending for two. Includes random shopping for the household and any fun money.

-

$300 for various gifts birthdays, Christmas, and extra spending to host Christmas or other events. Half of this is just building up for winter where we spend a decent chunk. Sometimes this is used to fly home for the holidays.

-

$400 home maintenance budget. Saving for big fixes or general repairs. This will be much higher there first two years. For reference I’ve got a few pending maintenance repairs that are likely to cost ~$6,000 each expected in the next 5-8 years. (HVAC, water heater, roof, landscaping to deal with erosion and eventually some remodeling). Budget also includes collecting tools.

-

Pets $200. Food, litter, toys, etc.

-

$130 Health related expenses. Doesn’t include insurance which is $400/month out of the paycheck.

And I’m going to plug YNAB which is why I have these numbers, it costs $120/yr which is included. Highly recommend doing some kind of budgeting even if it’s on paper in a notebook once a month because all these costs can creep up. If you want free electronic use a spreadsheet.

And I’m going to plug YNAB which is why I have these numbers, it costs $120/yr which is included. Highly recommend doing some kind of budgeting even if it’s on paper in a notebook once a month because all these costs can creep up. If you want free electronic use a spreadsheet.

My problem with getting and staying on budget is keeping up with data entry, YNAB and it’s ilk are all too manual. And the automatic ones have issues pulling together all my accounts and reconsilling the transactions between them. For example, a $10 PayPal debit from my bank account and it’s companion PayPal transaction should be correlated as the same transaction, but all the softwares I’ve tried would automatically treat them as separate no matter what I did. Which would ultimately throw off all the nice budget numbers making them uselss

I was hoping the genAI craziness would at least bore out a great fully automated budget system that would at least mostly solve my problem, but alas I still have yet to hear anything on that front :/

While not really a budget tool per say, I’d recommend checking out Beancount if you are looking for a power tool and you are comfortable with a bit of Python. The only really manual steps I have in my setup is downloading transactions from my banks and categorizing any transactions that the machine learning plugin fails to categorize.

It’s definitely tedious to track everything. I do like the import feature and it covers maybe 80% of day to day transactions but yeah it’s a pain to go and fix stuff. What your talking about with PayPal is what YNAB considers a transfer and payment and is usually part the 20% I have to fix. Bank to PayPal is a transfer transaction, PayPal to purchase is the payment. It can definitely get needlessly complicated and it sometimes automatically imports correctly, especially reoccurring payments or if the transfer is between two linked accounts.

-

Feedback: your actual questions start about 2/3 down your post. Lead with them next time so we know how to answer better :)

it’s really hard to apply my city-living experience to try to extrapolate what life might be like if I make a goal to buy a small home in Nowheretown, USA to retire in 20 years down the line

We have younger kids, live in a lower cost of area, and bought our house in 2011. Excluding frivolous categories, our top expenses are:

- Saving for our retirement. Between our 401ks and IRAs, this is our biggest expenditure by quite a bit

- Food. We don’t eat out a ton, but also don’t do a great job of eating low cost. Feeding four is also fun, we can’t wait until they’re teens. This category is not much ahead of #3 though

- Our mortgage (it’s a 30 year and taxes, insurance, principal, and actual mortgage are $1,250/mo)

- Saving for our kid’d potential college tuition

Once the kids are out and we’re retired categories #1 and #4 go away, category #2 will probably get cut in half, and our taxes and insurance are currently well under $4,500/year. Speaking of taxes, mine are capped at a maximum increase of 5% or inflation, whichever is lower. With the housing run-up this has worked out in our favor.

Home expenses are a thing. It’s hard to say how much to budget for that though. Some of it depends on you (eg do you really need to renovate that bathroom in full), your taste, and your budget. I would expect a decent outlay every 5 years or so - roof, brick/siding/exterior work, furnace/ac, driveway etc. The more you’re willing and able to do yourself the better off you’ll be.

You don’t have to be in the boonies to live in a low cost of living area.

Maybe ask a more local community instead of people from around the world. The variation is huge within the US but its even bigger among lemmy users.

I’m having a well drilled at our offgrid property in Montana. Quoted at $60/foot and expect water at about 150 feet. Add in a pump, pipe, wire, pressure tank etc and I expect to pay about $15k. But keep in mind, the only cost you’ll have going fwd is electricity. Pump/ pressure tank should last 10+ yrs. Your mileage may vary.

Property taxes are super cheap now because we dont have any services yet ($75/yr on 20 acres) I’ll answer more questions if you gottem.

Septic vs sewer: septic is self- reliant and completely on your property. Might have a small pump or not depending on your lot. Call in a truck every 5 yrs or so at maybe $300 to pump your tank out. Sewer is a monthly fee to city, forever and ever. Maybe $40/mo?

One other thought that occurred to me overnight: you might be asking about FIRE (financial independence, retire early). There are tons of strategies for going about that.

I would caution about moving toward “off grid” type scenarios. Your monthly costs will be less, but you will have significantly higher up front (if buying a new residence) and/or maintenance costs (if buying used and/or when you decide to sell). For example, our water and sewer bill is around $800/year. If anything outside the house fails, the utility company will fix it. My in-laws sold a home in NJ with well water and septic and had to replace their sceptic field before they were able to sell. That set them back somewhere between $30k and $40k. Depending on your goals it could be either an advantage or a disadvantage.

You’re catching me right after paying bills. ;)

Portland, Oregon

Mortgage - $2,000 - 3 bedroom house, 1,300 square feet, 1,800 square foot yard.

Electricity - $175 - high this month because of air conditioning. We have solar panels so it’s not generally like this.

Water - $100

Garbage - $100

Internet - $75

Gas - $25 (not running heat this time of year)

Car insurance - $245 (2 vehicles)

Unexpected expenses? Mostly things we wanted/needed to do. We bought the house with a 20 year old roof that was end of life so job #1 was a new roof, got that done. Added solar panels.

Sink in the utility room needed an overhaul, plus some other plumbing expenses.

Electric panel was 100A which was fine in 1951, not fine now, so upgraded that to 200A. Also added a hot tub circuit. + a hot tub.

In Florida. Small 3/2. Biggest expense is home insurance. In Florida it is crazy expensive. 10k a year with windstorm at a crazy high 20k deductible. And insurance demands a new roof under 15 years old, even if the roof has a 20 year warranty.

Taxes are 6k a year. That’s with all the benefits I could claim.

Everything else is 2k a month.

Everything except house upkeep. Everything breaks and Everything is so expensive to get fixed with a pro. I’ve learned a lot of DIY , but there are things you just can’t tackle. Plumbing, 220 electrical, HVAC… If anything breaks prepare to spend 1k to 7k depending

I’ve never owned a home but what people have told me is that you will spend 13 or 14 monthly payments per year, 12 of them on the loan, and the other 1 or 2 on the related expenses. Insurance has gone up a lot around here since then though.

I know you can rent a tiny home plot with water and sewer in the (expensive) SF Bay Area for $800/month including some amenities (deltabay.org) so that is sort of an upper bound. This includes an electric hookup but you have to pay by the KWH for power. You can order a 400 sq foot tiny house (container home) on Amazon for about $20K (https://www.amazon.com/dp/B0D9Q3391S) though that’s just for illustration purposes. I don’t know enough about them to actually recommend that approach, plus I hate Amazon. So I would try to buy direct if I pursued that.

Mobile internet coverage is pretty good now, unless you’re waaay out in the boonies to the point where you have to ask whether there are even roads to get there with. So if you don’t use a lot of data, that gets you online fairly inexpensively. The next thing after that is Starlink, which is way less expensive than I thought, $300 for the dish tranceiver plus around $150/month for “unlimited” service.

The deal with well water depends a lot on the location. In the western states there are often legal restrictions. In drier places you have to drill very deep, which is expensive. If there is surface water, it’s less bad. In the desert (Joshua tree), a 1000 gallon truck delivery is around $100 (10 cents a gallon) iirc. I looked into this because a friend was interested in building a biodome there. So you are ok for careful usage but typical suburban use with frequent laundry and toilet flushing could get expensive. If you use a well, you might have to process the water to get rid of dissolved metals and solids, some of which can be toxic.

Propane, again, some company delivers a 400 pound tank every few months, which means there has to be a road that can get it there, or you need some other way (ATV) to move it. I guess you can use smaller tanks if that’s easier. A friend of mine had this and I think they swapped the tanks around, as opposed to refilling stationary tanks from a truck, but I can ask her. It’s possible that I’m confused.

Solar electricity and solar hot water are very doable now. You can buy a pretty good ready-made battery bank from Home Depot or similar, almost as cheaply as you can DIY without serious scrounging. Again I know a guy with around 10KW of solar panels and 10KWH of batteries iirc. He may have spent around $15K on this though he DIY’d. There is a substantial tax credit against solar expenditures here in CA, plus he gets paid when he feeds surplus power back to the utility (net metering), so he is doing pretty well with it. I think that setup is enough to run all normal household stuff most of the time. Maybe you want a backup generator around.

There is a really good old reddit post about solar hot water. I think it is here: https://old.reddit.com/r/diySolar/comments/b5leqm . The person made a huge coil of black PVC tubing exposed to the sun, with the water circulating through a big tank, and this was enough to give him plenty of hot water year-around with a few K$ worth of stuff, plus electricity to run the pumps.

Lately there are developments in ways to extract water directly from atmospheric humidity, even in the desert. I like to say that this is just like the moisture farming I used to do back on Tattooine ;). Web search: “atmospheric water harvesting”. Maybe this will become practical soon.

There are a lot of homesteading forums that might be better places to discuss this stuff.

Is there a location you are thinking about? For now, my own interest is sort of academic, but I have been following stuff a little bit.

All told though, I always hear that city and suburban nerds like me often think this lifestyle sounds great, but they get sick of it quickly when they actually attempt it.

If everything was paid off with taxes and income it would be around 1000 to 1500 if it’s a hit month. Taxes and insurance are quite a bit in California.

My place isn’t paid off but it is cheap enough that I can say what would change and, importantly, what wouldn’t.

My monthly payment is just under $700 a month. About $400 of that is the actual mortgage. The rest is basically property taxes and insurance. I’d save $400 a month but would still have to pay $300. Assuming I didn’t decide to just earn $400 less a month then that $400 would have to go back into the property. I need a new roof. I need a new HVAC (AC died three years ago). A new roof and AC would cost almost a quarter of my original mortgage. So in the end not much would change financially.

An important thing to remember about home ownership is that on average you are going to spend about 1% to 3% or a dollar a square foot on home maintenance each year. I had to replace my septic system months after buying the place, 7.6% of the home price. I had to replace my water heater a few years ago. Fortunately it’s located outside the building so no water damage and I was able to do that replacement myself so instead of spending $1800 for someone else to do it I did it for $450.

Once I have even a little spare money I need to do some roof repairs, not pay someone else to do it.

That’s a little known fun fact about owning a house when you’re not a millionaire. You need to get handy.

I have an ~1800sqft house in the US South East in a LCOL area.

• Garbage collection is $5/wk

• Water + Sewage is ~$150/mo

• Electricity is ~$150/mo

• Internet is $55/mo

• Propane is ~$150/yr

• Lawn Care is ~$800/yr

• Property Tax is ~$2400/yr

• Home Insurance is ~$1500/yr

• HOA is ~$1400/yrWe will probably spring for pest control next year which I expect to be about $100/mo

Unless I bungled the math, that works out to $11,970/yr

This obviously doesn’t include any maintenance, repairs, or improvements

EDIT: Just saw your second edit. Propane is still new to us; last winter we heated almost exclusively with the heat pump. This year we plan to try using the propane more and see how the cost differs. We pay $100/year to rent a tank and the propane truck comes by once a month and tops it off. Then we get a bill for however much they add.

I’m personally in a small 3 bed 2 bath single family house in MN. The place looks like a crack den on the outside but the inside is cozy enough. It’s not even rural, it’s technically in a “minor metropolitan area” (aprox 70,000 population).

I pay about $950 per month for mortgage, taxes, and insurance. (It’s all in escrow so IDK what they are individually off the top of my head). I pay about $120 per moth for 100GB down 20Gb up internet. I pay on average about $200 per month for electricity (more in summer less in winter). My water and trash are a basically just a rounding error alongside the rest (less than $100 per month combined).

As far as unexpected expenses go, the big ones are furnace and water heater. I had an emergency furnace repair last winter and that put me back like $500 despite the issue just being a bad gas valve and him having to do all of 5 minutes of troubleshooting because I had identified the exact issue prior to the tech showing up. If you can do your own work then you can mitigate these costs quite a bit but generally you’re best off having like $5,000 laying around in case of any emergency issues not covered by insurance.

When it comes to more rural my dad lives not far from me and he has a well and septic tank. Both are nearly 2 decades old and have not needed any maintenance other than getting the septic tank pumped every few years which costs about $300. Well expenses are just maintenance costs (like I said his hasn’t needed any in nearly 20 years) and the electricity cost for pumping the water which is negligible. Regular water testing is also generally recommended but generally speaking if the water starts out fine then it will stay fine unless something major happens in the area. He only heats his garrage via oil but it’s really not too much different from other methods. Generally you will pay a company that fills your tank at regular intervals and they’ll just bill you for how much they have to put in. So it winds up being much larger payments but you also only make them once or twice per year.

I have some relatives who are really out in the boonies and their internet is really garbage but they could also probably get better internet via satellite and I’m not sure how that works. If you’re really remote like that you will also want things setup like backup generators and you will need to know how to do your own emergency maintenance because sometimes you just can’t make emergency service calls. You also need equipment to manage your land, most of those relatives have at least a tractor with a bucket and blade attachment. You will also need a vehicle that can handle unmaintained roads especially in areas that get heavy snowfall.

I spend about $1500/yr on home insurance, average about $4,000/yr on home upkeep (repairs, improvements), another $1500/yr on property taxes, and maybe $2,000 on utilities including garbage collection. 1050sf SFH on Chicago’s West Side.

So let’s say $9K/yr, which is about 14% of my income.